NEW FEATURE: Embedding Financial Support in Existing Customer Journeys. Learn more.

We believe that no stone should be left unturned to support vulnerable people, that is why we offer the widest benefits coverage available in the market – you can view here our full benefits coverage. In this new article, we are exploring the additional benefits that we can find for our customers and the impact on their financial resilience.

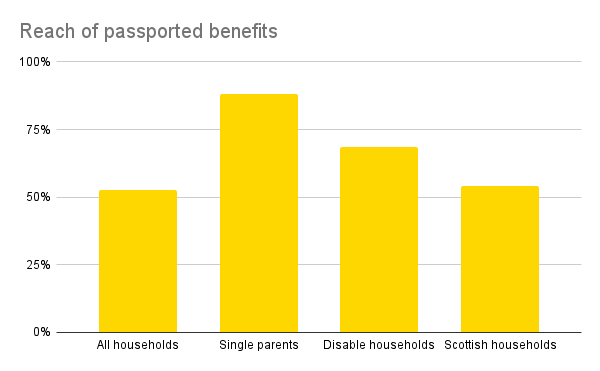

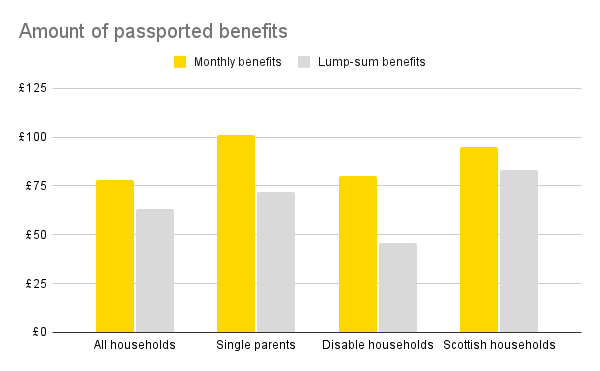

Passported benefits are a powerful tool to provide extra support to groups that are especially vulnerable, such as single parents and households with a member with a disability. Regional and local governments also use passported benefits to align their welfare systems to their social and economic policies.

There are numerous passported benefits across the UK and their regulations change between the different countries and councils. Therefore, more often than not, people struggle to find out their benefits entitlements or they are not aware that many of these benefits even exist. While most of the benefits calculators include means-tested, contributory and non-contributory benefits, we make sure that our customers are also aware of the passported benefits they are entitled to.

Overall, 53% of our users are entitled to passported benefits and they can earn on average £78/month and £63 in lump-sum payments. However, passported benefits have a wider reach and impact on the following segments:

To sum up, by including passported benefits, we ensure that people at higher risk get all the support available for them. Feel free to reach out if you want to see our platform in action and learn how we are helping vulnerable customers to access their benefits and improve their financial resilience.