From Planning to Execution: Barnet Council's Guide for Benefits Take-Up Campaigns

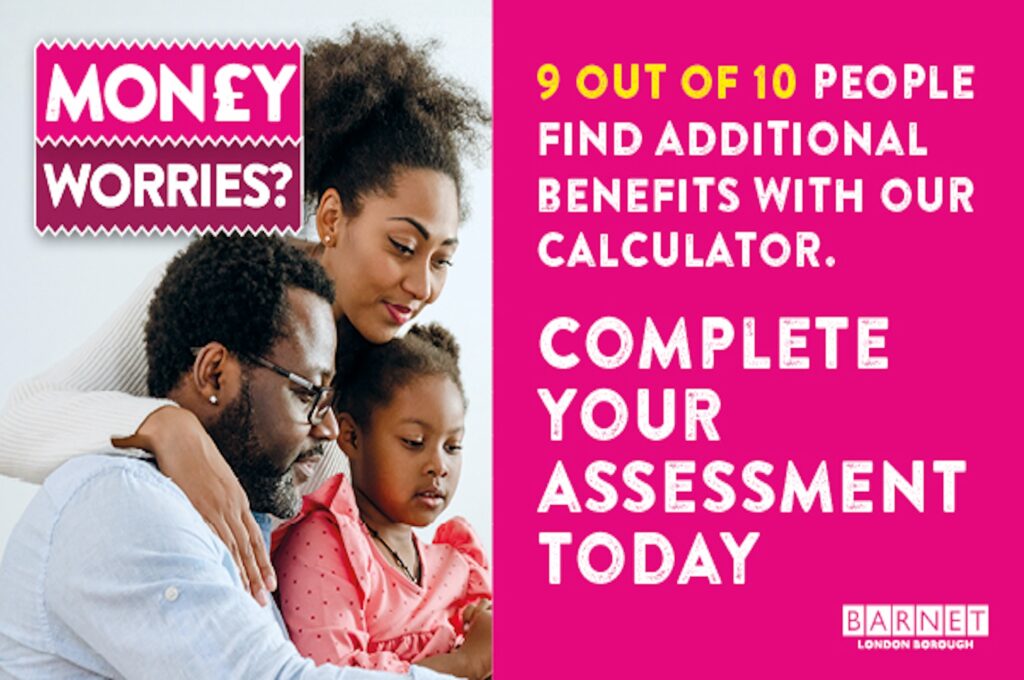

The London Borough of Barnet launched the “Money Worries?” campaign to ensure that residents know all the support they are eligible for. In this article, we’ll explain the campaign’s objectives, how it was run, its outcomes, and what we learned from it.

We also aim to introduce a replicable and open framework that local authorities can use to deliver efficient and effective benefits take-up campaigns. This framework enables councils to learn best practices and adapt them to their local communities’ characteristics, needs, and challenges. We encourage Revenues & Benefits teams to enhance this framework by sharing their experiences and learnings to continuously improve the delivery of local welfare services nationwide.

Campaign Overview

The “Money Worries?” campaign was designed to improve residents’ financial well-being and resilience by helping them access all the benefits for which they are eligible. At Barnet, we recognise that preventing financial hardship and helping residents improve their financial resilience is essential for enabling them to thrive independently on their terms.

Our income maximisation strategy also offers significant benefits to the council:

- It prevents financial hardship, which is more cost-effective than dealing with the consequences.

- It reduces Council Tax arrears.

- It boosts the spending power of residents, which in turn supports the local economy.

The most common reasons people miss out on benefits are a lack of awareness, the perceived complexity of the application process, and the stigma associated with claiming benefits. The campaign’s objectives were to raise awareness and reduce stigma among residents likely to be eligible for benefits but not apply.

The campaign was timed between late January and early April. This period was selected because household budgets are typically tighter after Christmas, making the campaign more relevant for residents and likely to motivate action. It also coincided with the dispatch of Council Tax letters, linking the effort directly to reducing arrears.

The main goal was to increase awareness of the council’s Financial Calculator and encourage residents to check the benefits available to them. We set specific targets to measure the campaign’s success. The key target was to reach 10,000 completed benefits calculations since the soft launch of the calculator in April 2023 or an additional 3,130 completed calculations during the campaign period. We also had targets around the number of people reached through physical outreach sessions, and the number referred to a new debt advice service in partnership with the Money and Pensions Service (MaPS).

Key Activities and Execution

The campaign’s primary objective was to offer practical support to help Barnet residents apply for the benefits they were eligible for but still needed to be claimed. The campaign’s key messages focused on the benefits available to Barnet residents, the accessibility of the Financial Calculator, and a clear ‘Call to Action’, encouraging residents to check the benefits available to them using the calculator. We also renamed the Benefits Calculator to Financial Calculator to address the stigma attached to benefits and avoid the misconception that working-age people are not eligible for benefits.

To maximise reach and impact, we launched targeted campaigns across social media, council communications, and collaborations with partner agencies. We also ensured that wider engagement methods were used to target those residents who may not see the core communications channels conventionally used by the council to distribute campaign messaging.

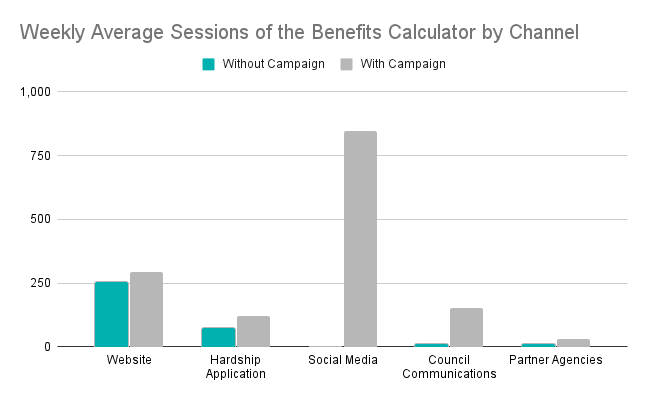

Social Media: We used geospatial data from Ascendant to identify specific postcodes where residents were particularly vulnerable. Our targeting focused on postcodes with the highest number of households showing low financial resilience, those where financial resilience was deteriorating rapidly, and households with unpaid council tax bills. This approach allowed us to reach traditionally deprived areas and more affluent sectors where residents were experiencing financial difficulties.

CAN (Council Advertising Network) Digital Solutions then used this information to place ads on social media platforms (e.g. Facebook, Instagram, and Twitter) to optimise our budget and impact. We continuously monitored the campaign’s KPIs—such as webpage clicks, calculator usage, and completions—to refine our approach, improve targeting, and optimise our advertising spend. Over the course of two specific phases of sponsored advertising delivered through CAN Digital, there were more than two million impressions or views of our campaign, with thousands of clicks to access more information.

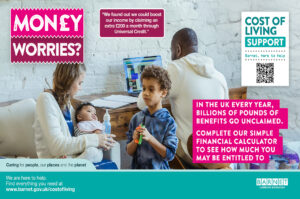

Council Communications: The campaign was integrated into our regular e-newsletters and prominently featured in the annual Council Tax letters, which included QR codes linking directly to the Financial Calculator. We also used traditional billboards on bus shelter sites to ensure comprehensive visibility across the borough. We carried out a targeted postal campaign promoting the calculator to residents identified through the work with Ascendant to identify people in Council Tax arrears.

Collaborations with partner agencies: Recognising the importance of reaching digitally excluded residents, the campaign included substantial physical outreach. Flyers and posters were distributed at strategic community locations frequented by vulnerable households, such as libraries, food banks, and children’s centres. The team also ran physical outreach sessions twice weekly at two libraries in the borough and is currently reviewing the success of those before relaunching in the coming months. Before the campaign, we trained staff at partner organisations to answer residents’ questions and assist them in completing the calculator.

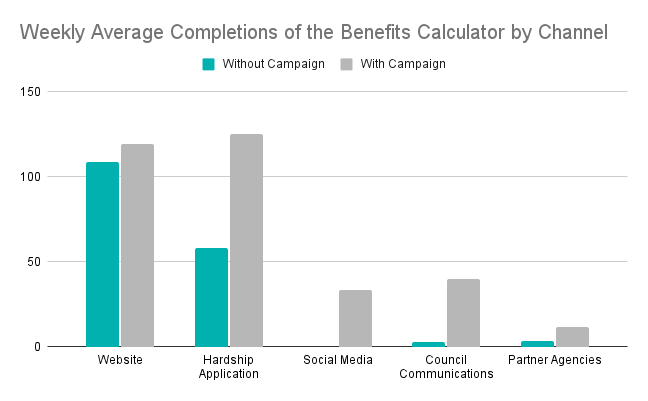

Existing Channels: The targeted campaigns positively impacted the channels where we displayed the benefits calculator, such as the Barnet website and the Hardship Grant application form. These channels benefited from increased awareness, leading to a significant rise in usage during the campaign period.

Campaign Outcomes

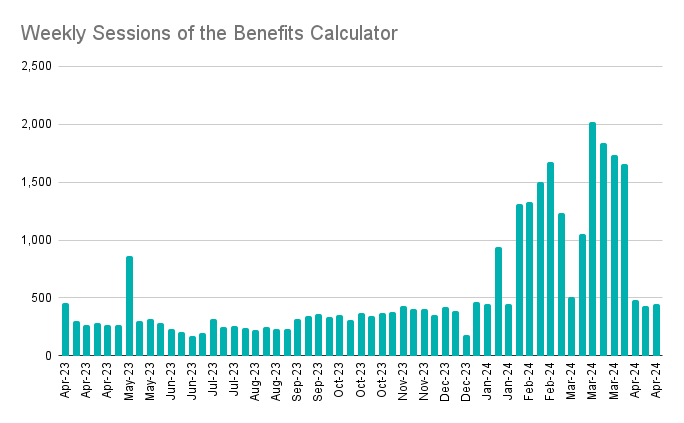

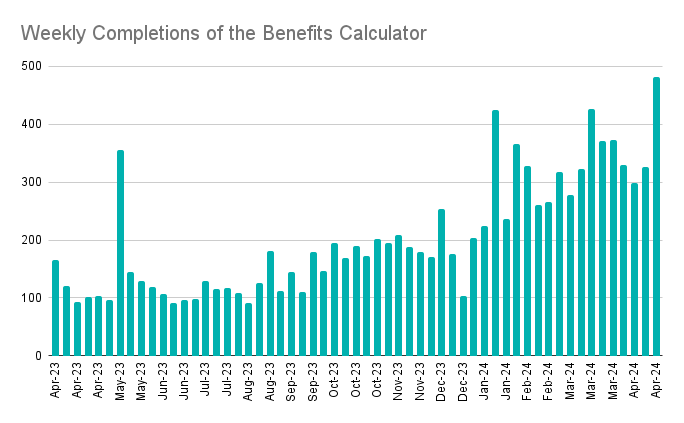

During the campaign, Barnet residents completed 3,634 unique full benefits calculations, which was 16% above our initial target. The average number of unique full benefits calculations per week was 330, nearly double the usual weekly amount.

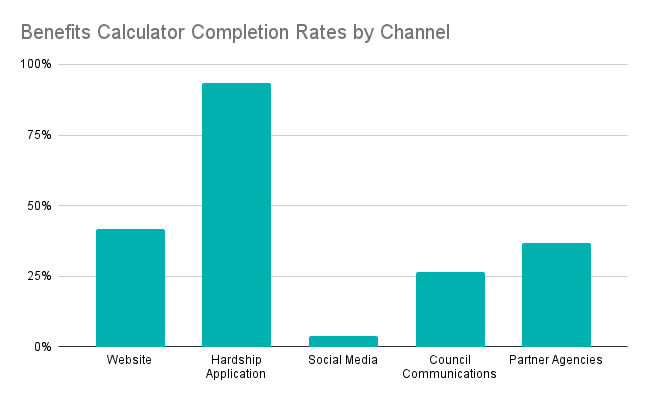

The average number of sessions increased by over 3.6 times, from 627 to 2,246 weekly. This increase was primarily driven by the social media campaign, which accounted for nearly 60% of the traffic increase. However, the completion rate for this channel was the lowest. Overall, the average number of completed benefits calculations increased by 1.9 times, from 173 to 330 unique weekly completions.

Lessons Learned

We’ve gained many valuable insights throughout the campaign, from the initial ideation meetings to the execution phase.

Stakeholder Buy-in: Starting in autumn 2022, securing early support from senior stakeholders was essential. At that time, elected members were addressing public concerns about the cost-of-living crisis. We presented our income maximisation campaign as a practical solution, highlighting the clear benefits for residents and the council. We kept stakeholders well-informed and involved in key decisions and milestones throughout the journey.

Collaborative Dynamics: The campaign was a collaborative team effort requiring active involvement from various partners and suppliers. Barnet Council spearheaded the initiative, while Inbest and Ascendant supplied the necessary technology. Good Impressions Limited, the council’s design and creative services provider, created the campaign artwork. CAN Digital Solutions executed the digital media strategy. Engaging with the broader support community ensured the campaign reached the most vulnerable residents.

Communications Strategy: A clear communications campaign was central to our efforts. It helped set the tone and ensured consistency in our messages across all interactions. This strategic approach was vital for engaging residents and ensuring senior stakeholders, partners, and suppliers understood the campaign’s goals and objectives.

Campaign Soft Launch: We started with a soft launch in May 2023 to test our strategies, hypotheses, and technology on a smaller scale. The feedback gathered during this phase helped us refine our approach and identify additional features and integrations needed to provide a seamless experience for both residents and case officers. This preparation allowed us to launch a successful campaign on a larger scale with full support from all stakeholders across the council.

Importance of Data: Having robust data analytics that were easy to use proved crucial. It allowed us to see the impact of the Financial Calculator from the outset and share these results with stakeholders. We could monitor the effect of every new feature in real-time, such as integrating the calculator with the hardship grant application form or observing the increased usage from tactical campaigns and new local partners using the calculator. This data helped us set clear goals for the campaign and build a strong case with measurable targets. Real-time tracking of the campaign’s KPIs enabled us to target our ads better and use our budget more effectively.

Future Directions

Income maximisation is a core initiative within our Financial Support model, and we are planning a second phase of the “Money Worries” campaign in the autumn. This campaign will incorporate the learnings (e.g. emphasising debt advice, which didn’t have such a positive outcome as the Financial Calculator completions) and focus on the support available for households to pay their bills, which generally increases in winter.

Additionally, we are collaborating with our partners to use the council’s administrative data to launch targeted and personalised benefits take-up campaigns. These campaigns will be tailored to meet each resident’s unique needs, ensuring our support is as effective and relevant as possible.

Conclusion

The “Money Worries?” campaign has been a key initiative of Barnet’s Financial Support model, reaching thousands of residents and significantly reducing Council Tax arrears.

This initiative has demonstrated the substantial return on investment possible through such campaigns and laid a strong foundation for ongoing efforts to support residents in thriving independently on their terms. For Local Authorities looking to implement similar initiatives, Barnet’s approach offers a replicable model that can be adapted to meet local needs, ensuring all residents receive the support they are eligible for.