ANNOUNCEMENT: Lloyds Banking Group integrates our Benefits Calculator. Learn more.

The main success factor of financial wellbeing applications is offering personalised features that require minimum information from customers, and then, proactively offering insights, suggestions and steps that help them to achieve their financial goals.

We are witnessing the benefits of this approach first-hand by embedding our benefits calculator in Scotcash affordable loan application process – you can read more about our partnership in this press release.

The most common reason why people miss their benefits is that they are unaware of the welfare benefits they are entitled to or assume that they are not eligible. So if people think they are not entitled to any benefits, why would they check, right? However, the consequences are dire because people who need benefits, but fail to access them, fall back on risky strategies to get by e.g. depleting their savings, borrowing and stopping paying bills, taxes and debt payments.

The only way to help these people to find out their benefits is by embedding a benefit check in complementary banking journeys they are already using. Affordable lending is a prime candidate to embed a benefits check as people reach these companies to get emergency cash and, in most cases, they are entitled to benefits – 90% of loan applicants to be precise! While an emergency loan can be enough to face unexpected expenses, it does not solve the underlying problem that their income is not enough to cover their basic needs and they don’t have an emergency savings pot.

The loan application process includes the information that we need to make a benefits check. Therefore, without asking for any further information, the service compares the actual benefits that customers receive with the benefits they are entitled to due to their specific circumstances and financial situation.

At the end of the loan application process, the service proactively notifies customers about any unclaimed benefits. Then, customers can access the benefits calculator to complete the full questionnaire, view the benefits they are entitled to and find out what they need to do to claim them.

This new feature is helping loan applicants to top-up their salaries with their benefits entitlement, reduce their bills, repay their loans more comfortably, and build savings in the future.

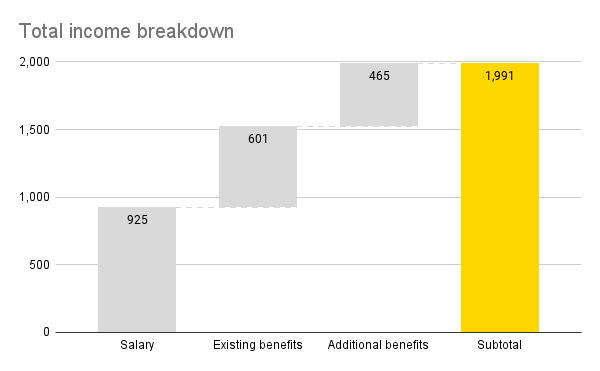

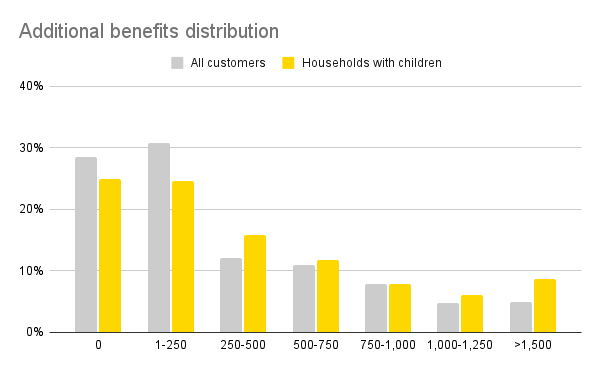

Overall, 70% of the loan applicants are missing some benefits. On average, these customers could claim additional benefits of £465/month and reach a total benefit entitlement of £1,070/month. This would increase their income by 30% to £1,990/month.

The impact is even bigger for households with children, who can claim additional benefits of £565/month and reach a total benefits entitlement of £1,430/month. This would increase their income by 34% to £2,240/month.

Embedding benefits into the loan application process also helps that 15% more customers finish the benefits questionnaire where they can view the breakdown of the benefits they are entitled to and find out what they need to do to claim them. We achieve this improvement with two main features:

Sharon MacPherson, CEO of Scotcash

By integrating our benefits calculator into your banking journeys you can identify the customers that might be entitled to additional benefits, proactively tell them how much they can get, and guide them on their benefits applications.

Feel free to reach out if you want to explore how you can embed a benefits check into your banking journeys and view our benefits platform in action!