ANNOUNCEMENT: Lloyds Banking Group integrates our Benefits Calculator. Learn more.

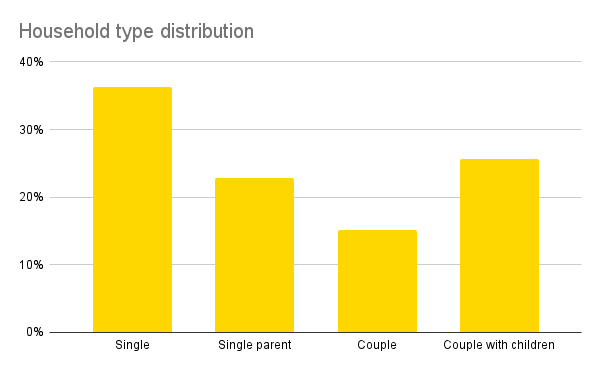

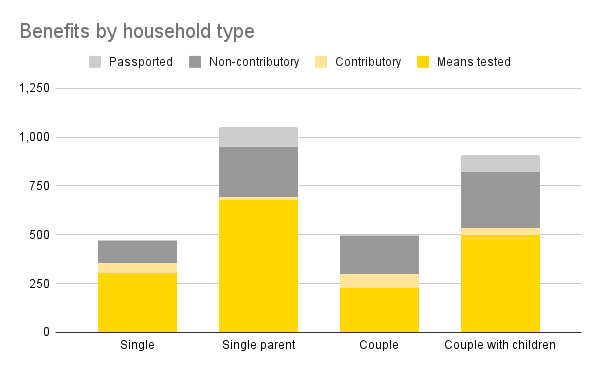

Households’ circumstances are the main driver of the benefits that each household is entitled to. On average our users were entitled to £885/month, but households in vulnerable circumstances, such as single parents and households with a member with a disability, were entitled to monthly benefits of £1,071 and £1,266 respectively.

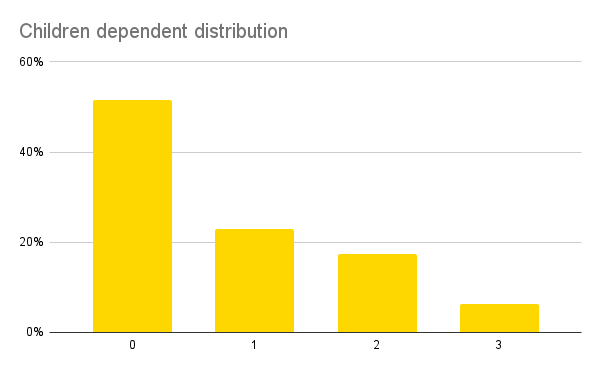

In this article, we will explore how households’ circumstances affect their entitlement to means-tested, contributory, non-contributory and passported benefits. We will compare how benefits entitlements change according to the type of household, the number of dependent children and whether there is a member of the household with a disability.

Household type refers to whether benefits applicants are part of a single or family household. Single parents households have the largest benefits entitlement with £1,071 in monthly benefits. This reflects the following characteristics of the benefits system:

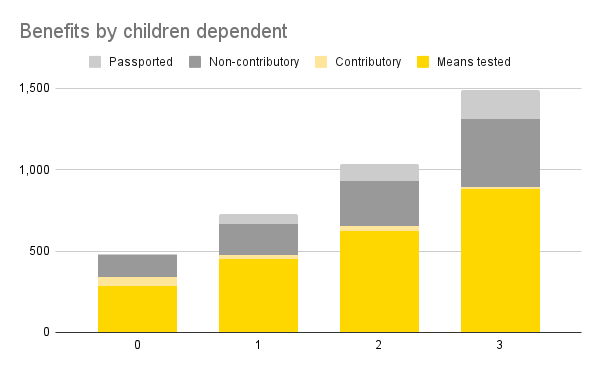

Half of our users have dependent children, and not surprisingly, their monthly benefit entitlement increases as the number of dependent children increases. The increase in the benefit entitlement is mainly related to the child and childcare component from Universal Credit as well as Child Benefits. However, in the coming years, the Universal Credit’s child component will have a lower effect as the two children maximum entitlement will affect more households.

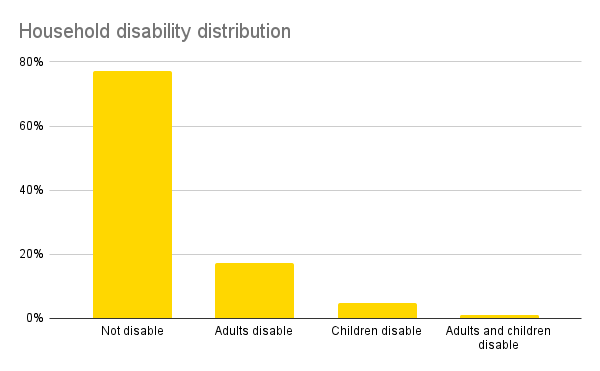

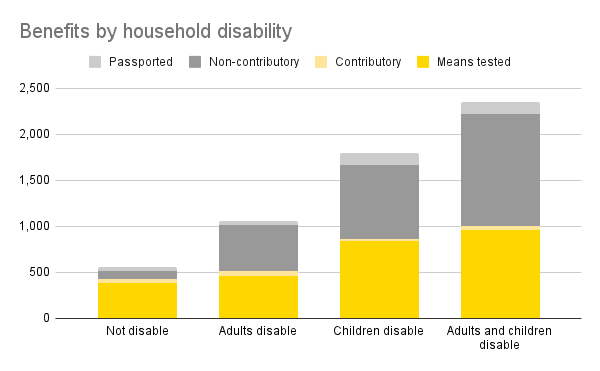

Most of our users do not have any members in their household with a disability. However, the households with a disabled member have an average benefits entitlement of £1,266/month, which can increase up to £2,353/month if there is an adult and a child with disabilities. This reflects the following characteristics of the benefits system:

We hope you find this article interesting and are looking forward to keeping reading our Data for Good series. Please reach out if you have any questions or you would like to explore how we could help your customers access their benefits.