ANNOUNCEMENT: Lloyds Banking Group integrates our Benefits Calculator. Learn more.

The Autumn Budget included changes in the Universal Credit calculation that increases the benefits entitlement of working benefit claimants. The Department of Work and Pensions reduced the taper rate and increase the work allowance. In this article, we analyse the impact of these changes on our users’ benefit entitlement and will detail how Universal Credits can help businesses to recruit and manage their workforce.

Universal credit claimants lose some of their benefits when they earn more money. The rate at which they lose the benefits is known as the taper rate. The new taper rate was reduced to 55% from 63%, which means that per extra pound in income benefits claimants will lose 55p instead of 63p.

Workers with dependent children or disabilities are allowed to earn a certain amount before they start losing their universal credit, which is called the work allowance. The work allowance has increased by £500 a year, also increasing the benefits entitlement of working benefit claimants.

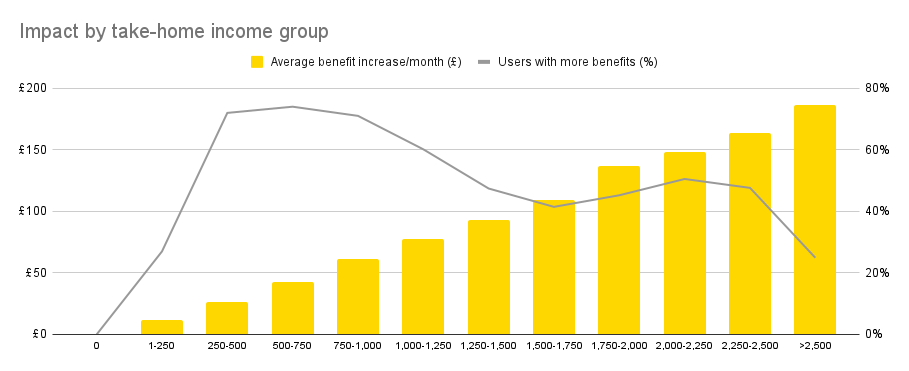

We have analysed the impact of the change in the Universal Credit calculation and the monthly benefit entitled of half of our users will increase by £92 on average (or £1,100/year). As a result, with this change, 76% (+3%) of your users are entitled to £568/month (+£47/month).

The impact of these changes diverges across the different income groups and households in the higher-earning brackets will benefit the most.

We have previously discussed how HR managers can support their employees to make the most out of their benefits and improve their financial wellbeing. However, Universal Credits also have important features to help employers to recruit and manage their workforce:

We partner with financial well-being platforms to identify employees who are missing their benefits and we help them to top-up their salaries with their benefits, reduce their bills, and manage their debts. Overall 76% of our users who are in employment are entitled to an average benefit amount of £568/month or 30% of their household take-home pay.

Get in touch to learn how we can help employees to access their benefits and improve their financial resilience and wellbeing.