Integrating our Benefits Calculator into Banking Apps

Lloyds Banking Group has recently launched a new Benefits Calculator to help customers discover all the benefits and discounts they’re eligible for. This tool is now directly available in the mobile apps of Lloyds Bank, Halifax, and Bank of Scotland, making it easy and convenient for customers to find and manage their benefits.

Lloyds Banking Group selected our Benefits Calculator to power this new service. Over the past few months, we’ve worked closely with their team to co-design the end-to-end customer journey, with one clear goal: to make it as simple as possible for customers to access and manage the benefits they are eligible for.

In this article, we’ll highlight the key advantages of integrating an income maximisation feature directly into banks’ mobile apps and explain why this approach is more effective than signposting to a third-party benefits calculator. If you’d like to learn more, we’d be happy to discuss how you can add a benefits calculator feature to your app.

Growing number of financially vulnerable customers

In the UK, 20.3 million people are financially vulnerable, with over 7 million families struggling to afford essentials like food and heating. Insufficient income is a key factor driving financial exclusion, and welfare benefits are one of the main tools supporting those who are financially excluded or at risk of becoming so.

Despite the life-changing impact that government benefits can provide, billions of pounds go unclaimed each year. Our data shows that two-thirds of our users miss out on an average of over £4,000 in annual benefits and discounts—an amount that could significantly improve their financial resilience and well-being.

The main reasons for unclaimed benefits include:

- Lack of awareness: Many people are unaware that certain benefits exist or assume they won’t be eligible.

- Complexity and fragmentation: Claimants often need to apply for multiple benefits, navigating complex criteria and eligibility requirements, creating significant barriers.

- Social stigma: There is a stigma associated with applying for benefits, combined with general apathy toward managing financial matters.

Integrating a Benefits Calculator to Banking Apps

Over 23 million people in the UK receive welfare benefits from the Department for Work and Pensions (DWP). These benefits are vital in helping individuals increase and protect their income, reduce their essential costs, and build their financial resilience.

By integrating a benefits calculator into their mobile apps, Financial Services (FS) institutions can help customers easily manage their eligible benefits from the same app they use to handle their finances.

This feature offers three key advantages for FS institutions:

- Improve Financial Resilience: Financial institutions can help their customers increase their income by an average of £4,000 per year, strengthening their financial resilience.

- Drive Customer Engagement: Welfare benefits are crucial to many customers’ financial lives. Offering this feature directly in mobile apps can increase app usage and give banks richer customer data.

- Regulatory Compliance: Support compliance with FCA Consumer Duty and the Fair Treatment of Vulnerable Customers.

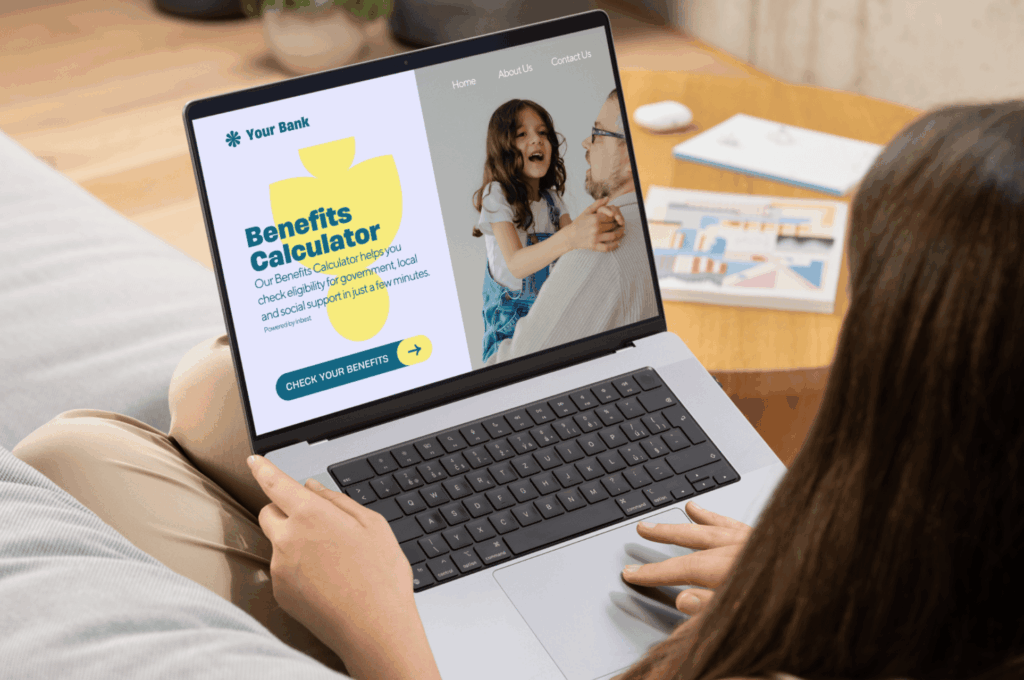

This is how the benefits calculator feature looks like on the Lloyds Bank app:

How our Benefits Calculator Works in Banking Apps

The Inbest Benefits Calculator is an all-in-one tool that helps customers check their eligibility for national benefits, social tariffs, and local grants while guiding them through the application process. FS institutions integrate our benefits calculator directly into their mobile apps, providing personalised, proactive, and continuous support for their customers.

Here’s how the end-to-end customer journey works within banking apps:

- Identify: We use existing customer data to identify customers who may be eligible for additional benefits.

- Notify: Customers who are potentially eligible for benefits receive personalised nudges through in-app notifications or push alerts.

- Calculate: Customers access the calculator, built directly into the bank’s mobile app, to check their eligibility for benefits.

- Remind: We track whether customers are applying for benefits and send periodic reminders if they haven’t done so.

- Update: We provide timely updates and news about relevant benefits, including seasonal support or changes in benefit rates.

To achieve these results, FS institutions should integrate the Benefits Calculator directly into their banking apps, rather than signposting customers to a third-party calculator. Signposting alone cannot offer critical features like proactive identification of eligible customers, personalised notifications, or the reminders and updates that drive continuous engagement. Additionally, with signposting, banks miss out on the ability to track whether customers apply for benefits and lose access to richer customer data.

How We Partner with Banks

We understand that each bank has its own strategic objectives, priorities, value propositions, and customer journeys. That’s why we tailor our solution to meet their specific needs. We start our partnerships with a series of workshops to understand the bank’s goals, the customer journeys they want to develop, and to establish integration priorities and timelines.

Our implementation process includes three key steps:

- Co-design: We work closely with the bank to integrate the benefits calculator into their customer journeys, ensuring we make the most of existing customer data, target the right customer segments, and create a seamless user experience with existing products and services.

- Co-develop: We customise the Benefits Calculator according to the bank’s specific business and technological requirements.

- Progressive Integration: Our goal is to quickly launch an initial feature, followed by continuous improvements based on the bank’s strategic objectives and customer feedback. This approach ensures a smooth, cost-effective roll-out that delivers tangible results and customer insights as soon as possible.

We have a proven track record of taking a benefits calculator from concept to launch in a bank’s mobile app in less than three months. Our IT infrastructure and assurance processes meet the highest standards in the banking industry, ensuring an efficient, reliable, and secure implementation.

Interested in Learning More?

We have extensive experience working with some of the largest financial services organisations in the UK, and our expertise and technology can help you quickly launch a key feature to support your customers.

We’ve successfully integrated our benefits calculator with major UK banks, and we’d love to show you how we can do the same for your organisation. If you’re interested in exploring how we can work together to launch a Benefits Calculator on your banking app, please reach out to us.