Why Financial Services and Fintech Companies Embed Our Benefits Calculator

In the UK, over 20.3 million people are financially vulnerable, with nearly 14 million having less than £100 in savings. An unexpected expense could push these individuals into hardship. Additionally, over 7 million families are already struggling, lacking essentials like food and electricity.

Against this economic and social backdrop, over 8 million households still miss thousands of pounds a year in benefits. Our mission at Inbest is to improve the financial well-being of UK households by helping them to get the benefits and discounts they are eligible for.

We certainly cannot achieve this enormous task alone. We are immensely proud to partner with over 100 like-minded organisations across the UK to ensure people get the benefits and discounts they are eligible for. These organisations range from government agencies, Financial Service institutions, and utility companies to nationwide Debt Advice Providers, Local Authorities, Fintech companies, and small welfare charities.

Organisations typically embed our benefits calculator to achieve three main goals: improving customer financial well-being, driving customer activation and engagement, and complying with industry regulations and best practices.

Improve customers' financial well-being

The most common reason people miss out on their benefits is a lack of awareness or the assumption that they are not eligible. At Inbest, we believe the most efficient way to reach households with unclaimed benefits is by integrating a benefits check into the products and services they already use.

Financial Services and Fintech companies are embedding our benefits calculator in various customer journeys. These include lending, collections & arrears, debt advice, personal financial management, specialised portals for vulnerable customers, and applications for social tariffs, grants, and hardship grants.

"One of the things I am most proud of about Salad Money is our pioneering use of in-application benefit checking. Last year, we identified over 36 million (pounds) worth of additional benefits for over 180,000 applicants, which earned recognition and coverage in the FT and the BBC and contributed to our Fintech for Good award."

Tim Rooney, CEO of Salad Money

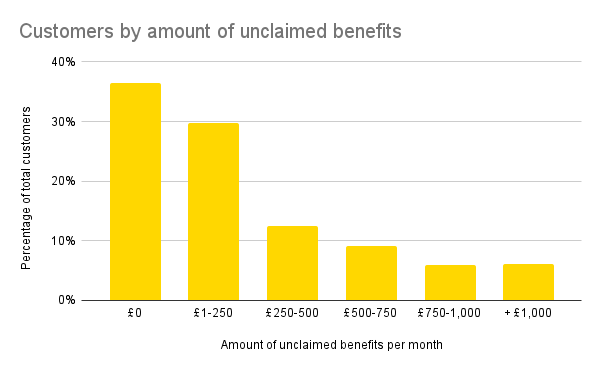

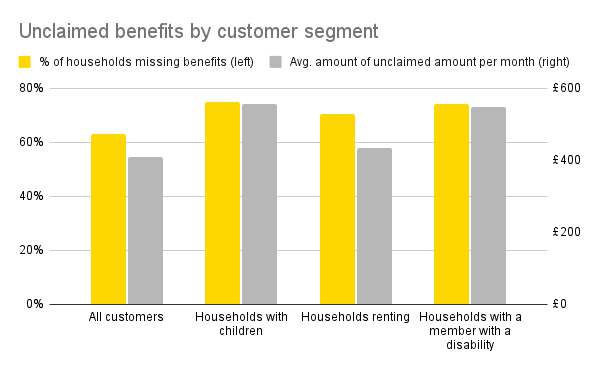

On average, over 63% of our customers are missing £409/month in benefits, or £4,900/year. However, the amount of unclaimed benefits is larger in certain customer segments, such as households with children, those renting, and households with a member with a disability.

In the following graphs, we present a detailed analysis of the unclaimed benefits among customers. These visuals offer insightful data on the extent of unclaimed financial support, highlighting the significant impact our services have in addressing this issue.

Drive customer activation and engagement

There’s no better way to capture customers’ attention than by helping them find additional income and discounts potentially worth £5,000 a year. This message incentivises customers to start using Personal Financial Management applications or the Financial Wellbeing applications offered by their employers. It also encourages people to synchronise their bank accounts using Open Banking to easily find and manage the benefits and discounts they are eligible for.

Our benefits calculator also aids our partners in sending personalised messages to re-engage customers who haven’t used the applications for a while. For instance, using existing customer data, our partners can send tailored messages indicating the additional income and discounts each customer might be missing. An example message is: “Hi John, you might be missing out on £350 per month. Use our benefits calculator to quickly find the benefits, grants, and discounts available to you.”

Financial Services and Fintech companies are embedding our benefits calculator in various customer journeys. These include lending, collections & arrears, debt advice, personal financial management, specialised portals for vulnerable customers, and applications for social tariffs, grants, and hardship grants.

“Over the last few months, we ran a ‘Get Winter Ready’ campaign, highlighting how Wagestream can help our members prepare for the winter months and the extra expenses that often come with them. In this campaign, we saw a sevenfold increase in members checking their benefits entitlement, one of our most loved features on the Wagestream app.”

Holly Reilly, Head of Client Success at Wagestream

Managing benefits and discounts requires continuous monitoring to ensure people claim the correct amount. Failing to do so can mean missing out on eligible benefits or overclaiming, leading to liability with the DWP. Our benefits calculator provides valuable touchpoints, allowing our partners to send personalised and timely nudges to drive continuous customer engagement, such as reminders to update their circumstances or information about seasonal benefits like Free School meals, School clothing costs, and energy grants.

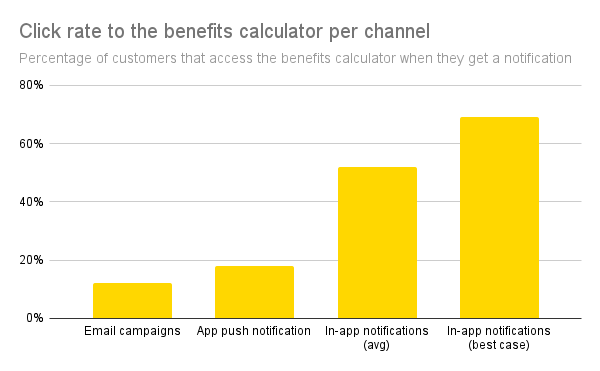

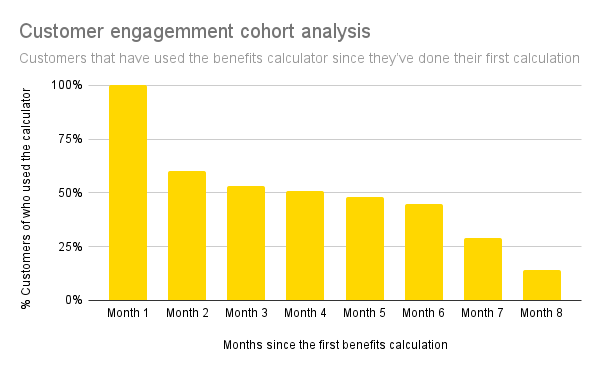

In the following graphs, we illustrate customers’ activation and engagement with the benefits calculator. It shows the click rate on different channels and the percentage of customers who have regularly used the calculator since their initial calculation, demonstrating its sustained value in customer engagement.

Comply with industry regulations and best practices

The FCA, Fair 4 All, and the Money Advice and Pension Service are using their regulatory powers, influence, and resources to ensure companies prioritise the needs of their vulnerable customers.

The FCA’s fair treatment of vulnerable customers and the consumer duty framework recommend FCA-regulated companies to provide income maximisation services. Although not explicitly prescribed, adding these services supports compliance with these regulations.

The Money Advice and Pension Service has incorporated income maximisation into the delivery plan for the UK Strategy for Financial Wellbeing, specifically within the Credit Counts pillar. In addition, their recent funding for debt advice and the “Debt advice clients with deficit budgets” report places greater emphasis on integrating income maximisation as part of the debt advice service.

Fair 4 All Finance is adopting a proactive, hands-on approach, actively supporting the community finance sector. They are focusing on the integration of income maximisation features into crucial customer journeys. This includes areas such as loan applications, the process for handling declined applications, and providing guidance on arrears and debt advice.

“We have seen instances of good practice already, for example credit union firms who have integrated a 'benefits calculator' link on their websites, aiming to assist consumers in securing the financial support to which they are entitled.”

The Financial Conduct Authority (FCA), Dear CEO letter March 2024

How to get involved

Given the current economic and social landscape, both public and private organisations in the UK are increasingly focusing on protecting and supporting vulnerable customers within their business strategies and product development plans.

Integrating a benefits calculator into existing customer journeys not only improves customers’ financial well-being but also serves as a strategic business decision. It enhances customer engagement and ensures compliance with industry regulations and best practices.

If you’re interested in finding out why Government Agencies, Financial Services and Fintech companies, including Money Advice and Pension Service, Natwest and Wagestream have partnered with us in our mission to enhance the financial well-being of UK households, please don’t hesitate to reach out. Our collaborative efforts are crucial in helping households access the benefits and discounts they are eligible for, thereby improving their overall financial well-being and resilience.