Embedding Financial Support Seamlessly into Existing Digital Journeys

Embedding Financial Support Seamlessly into Existing Digital Journeys Every year, millions of people miss out on the financial support they are entitled to, often because they don’t know what help is available or assume they won’t qualify. The most effective way to identify the benefits people are eligible for is to complete a benefits calculator. […]

Reaching Every Resident: Lessons from Barnet’s Award-Winning ‘Money Worries’ Campaign

Reaching Every Resident: Lessons from Barnet’s Award-Winning ‘Mon£y Worries’ Campaign Last year, Barnet Council launched its “Money Worries?” campaign to raise awareness of the support that residents could claim. Since launch, over 20,000 residents have completed the full benefits calculations and the “Money Worries?” gained industry recognition. It was ‘highly commended’ at the Comms2Point0 Unawards […]

Partnering with Hope4U to Offer Personalised Advice via Our Benefits Calculator

Partnering with Hope4U to Offer Personalised Advice via Our Benefits Calculator We are thrilled to announce our partnership with Hope4U, a national welfare advice agency. This collaboration allows us to deliver human-led advice directly through the Inbest benefits calculator. This service helps vulnerable customers maximise their income and build financial resilience, and it is now […]

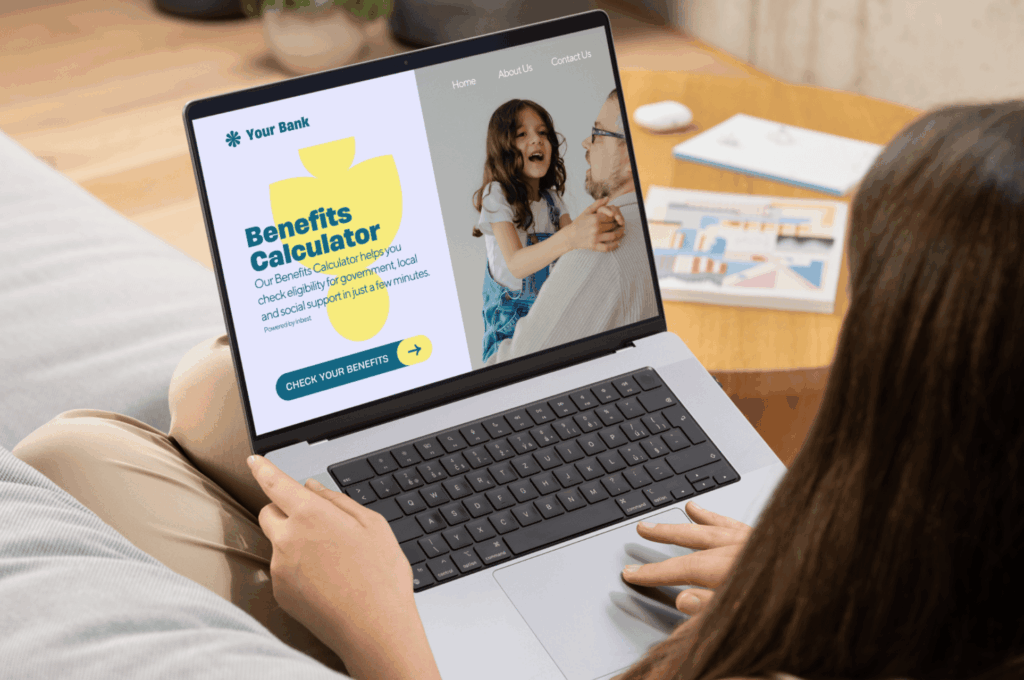

Integrating our Benefits Calculator into Banking Apps

Integrating our Benefits Calculator into Banking Apps Lloyds Banking Group has recently launched a new Benefits Calculator to help customers discover all the benefits and discounts they’re eligible for. This tool is now directly available in the mobile apps of Lloyds Bank, Halifax, and Bank of Scotland, making it easy and convenient for customers to […]

Debt First Aid Journey

Debt First Aid Journey When people fall into arrears, they often face challenging choices, from making significant lifestyle adjustments to pursuing formal debt solutions that may affect their future credit options. Our Debt First Aid Journey helps customers struggling to pay their bills and credit commitments to understand the options available to address their debt […]

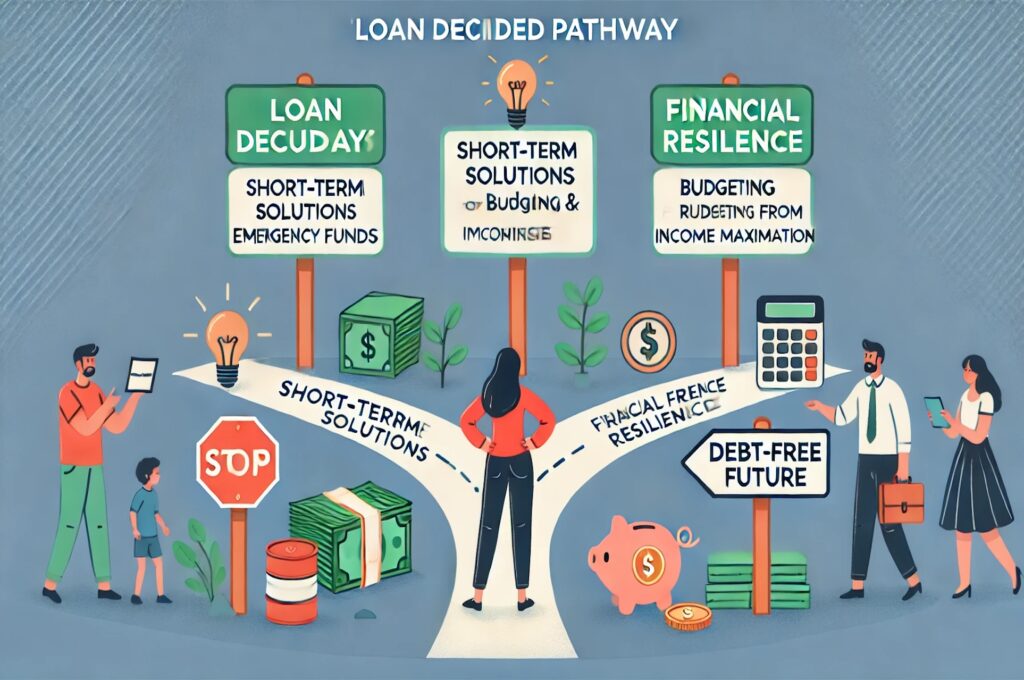

Loan Declined Journey

Loan Declined Journey Once a customer has been declined for a loan, their need for credit doesn’t go away. More and more people apply for loans to pay for everyday essentials, like utilities and food – things they should NOT need credit for. Our Loan Declined Journey provides personalised alternatives for customers who have been […]

Free Offer to Identify Pension-Age Residents Missing Out on Pension Credit

Free Offer to Identify Pension-Age Residents Missing Out on Pension Credit The Department for Work and Pensions (DWP) recently published that Pension Credit applications have increased by 152% after the benefits take-up campaigns launched by both national and local governments. This demonstrates the positive impact of these campaigns in helping households receive the benefits they […]

From Planning to Execution: Barnet Council’s Guide for Benefits Take-Up Campaigns

From Planning to Execution: Barnet Council’s Guide for Benefits Take-Up Campaigns The London Borough of Barnet launched the “Money Worries?” campaign to ensure that residents know all the support they are eligible for. In this article, we’ll explain the campaign’s objectives, how it was run, its outcomes, and what we learned from it. We also […]

Data Analytics for Local Authorities

Data Analytics forLocal Authorities Inbest Data Analytics enables Local Authorities to combine their administrative data with our benefits calculator. This easy-to-use application provides rich insights into residents’ profiles, supports the design of Council Tax Reduction Schemes, and helps councils manage targeted benefits take-up campaigns. User-Friendly Web Application Inbest Data Analytics is a self-service web application […]

Design of Council Tax Reduction Schemes

Design of Council Tax Reduction Schemes Visionary Network, Ascendant Solutions, and Inbest collaborate with Local Authorities to design their Council Tax Reduction Scheme (CTRS). Combining our extensive experience in Revenues & Benefits with our software and data analytics tools, we deliver customised designs, in-depth impact analysis, and enhanced communication of CTRS. Our primary focus is […]